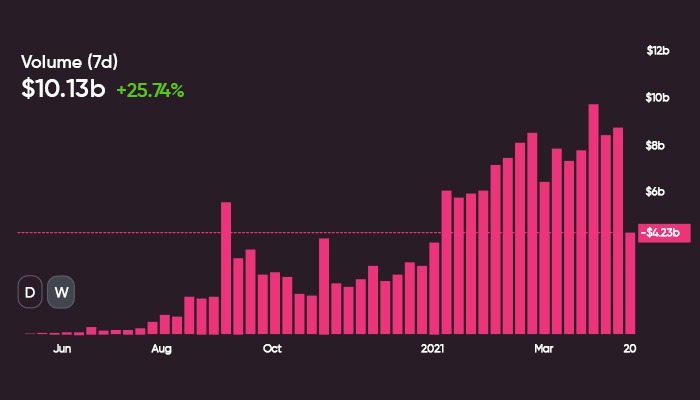

In past episodes of this series of articles, I stated that the Blockchain technology would certainly expand its scope from cryptocurrencies themselves to other financial and capital markets. The most substantial evidence in this regard is the incredible rise of Automated Market Makers, starting from 2018.

In the following lines, I would like to explain how this new market segment works.

Market makers and traditional trading

As the concept of Automated Market Makers is a modification of the traditional trading system, we will start with a definition of so-called non-automated market makers.

Beginner investors find out fairly quickly that brokers (or trading companies) are not the only trading intermediaries. Market makers are the second link in the seller-buyer chain. They have two primary responsibilities:

1. Ensuring the market’s liquidity, in other words providing the necessary asset volume needed to carry out extensive transactions.

2. Establishing the bid and ask price, with the difference being the spread. Market makers ensure that an investor (or, as a rule, the broker designated by him) can trade within these limits. The profit comes, predictably, especially from the difference between these prices and is shared with the brokers.

It is easy to understand why traditional market makers must be massive financial institutions to assume such a status. Depending on the asset class/classes in which it operates, the role falls in the hands of several types of institutions:

• Stock Exchanges: for shares and other similar assets. The role is mainly assumed by famous stock exchanges such as the New York Stock Exchange or the London Stock Exchange.

• Banks: trading fiat currencies.

• Specialized market makers: for example, these are used by exchanges like NASDAQ.

Regarding the difference between market makers and brokers, Investopedia offers a relevant and easy-to-understand comparison: the former resembles wholesalers, while the latter has similar characteristics to retailers.

I know from personal experience that some brokerage firms can turn into market makers over time, just as a delicatessen can launch its gourmet brands for distribution in other stores.

However, I can confirm that the two businesses remain conceptually different when referring to department structure and functionalities.

What does the Blockchain bring new to the table?

Because I talked more in-depth about Blockchain in one of my previous articles, I will not insist on technical aspects. Through Automated Market Makers, I will only say that it makes the leap from the actual cryptocurrencies to the markets where these are traded, and this leap is currently taking place right before our eyes.

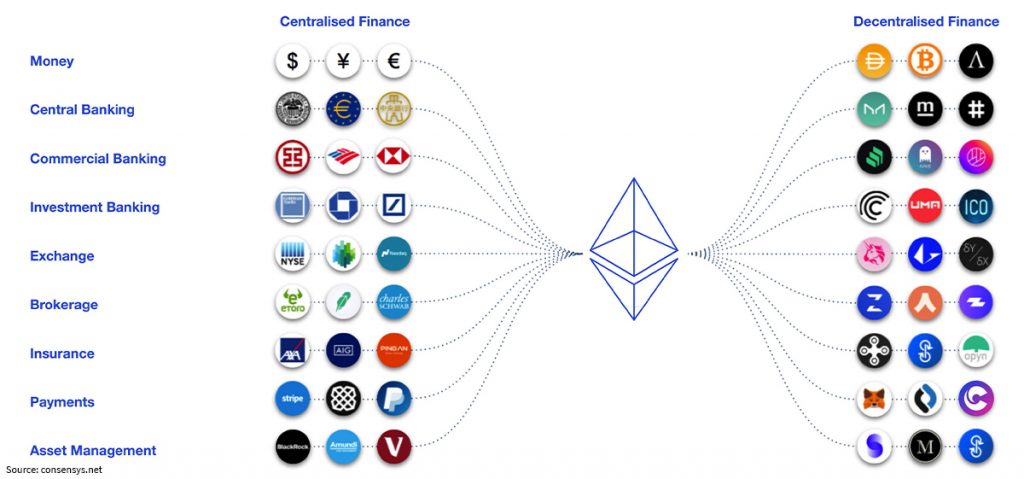

This is one of the first manifestations of the ecosystem called by specialists DeFi (Decentralized Finance). In the market maker segment, the Blockchain breaks the monopoly of large financial institutions through automation. The walls, the offices, the employees and especially their massive liquidity are replaced by something that looks more like a software structure.

In short, the term Automated Market Makers (AMM) defines:

• A software architecture based on Blockchain, digitally connecting liquidity providers with brokers and trading companies. In turn, these will interact with investors, most likely through online platforms.

• A mathematical formula that sets the maximum liquidity in a given area.

• At the moment, Automated Market Makers make transactions between cryptocurrencies and fiat currencies or tokens (value symbols derived from them) possible. However, the technology applies to any asset transaction, and I do not doubt that it will be used in the future.

• Very low commissions (these can even go to zero, but in this case software creators can no longer turn in a profit).

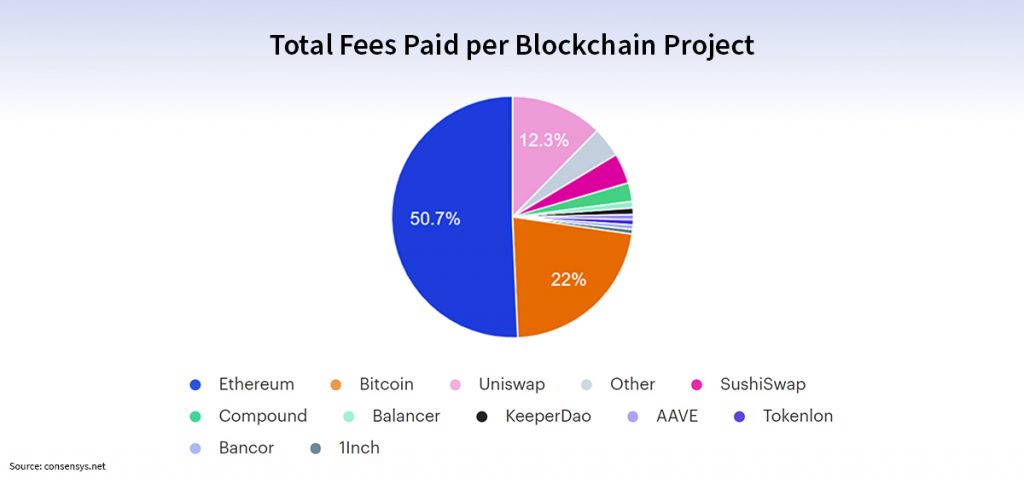

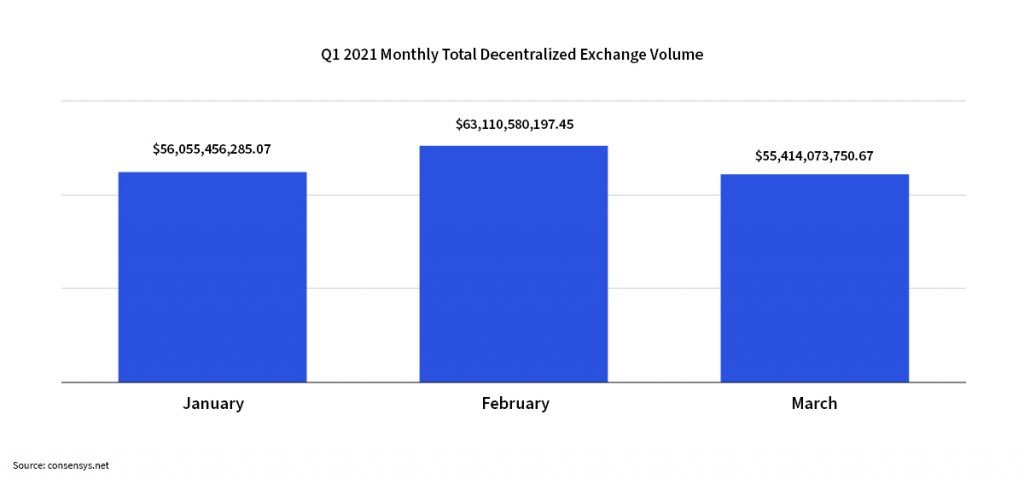

Since 2018, Uniswap, Sushiswap, Curve, Balancer or Kyber Network have entered this new market. In the case of Uniswap, the AMM with the highest volume, the operating formula is straightforward: x * y = k, where x and y represent assets, and k stands for the total liquidity in a specific area. One of the working principles here is that the liquidity in the respective area does not change for the symmetry of the transactions.

Other Automated Market Makers use more complicated mathematical devices. However, it is clear that the Blockchain brings clear advantages here, such as:

• Very low costs for users, between 0.1% and 0.3% for large Automated Market Makers.

• Secure, decentralized processes.

• A competitive market, with clear benefits for customers, because anyone can create a segment / become a market maker, even if it does not automatically entice success for that market.

For that market to function, the Automated Market Maker must attract so-called Liquidity Providers, who charge commissions because they provide the necessary volume of assets. This way, the so-called Liquidity Pools are created for each pair of assets. Formulas such as the one mentioned for Uniswap help adjust the price according to demand and supply.

Automated Market Makers also have another significant advantage: the so-called smart contracts, created from computer codes. These contracts are impossible to break because they extend the software architecture represented by the market and the respective pools.

Precautions and the future

Automated Market Makers are an explosive market, but it is only at the beginning of its evolution. At the moment, it suffers from a series of inherent disadvantages, such as the possibility of error (even if it is not the market maker who makes them, but the user because the latter can cause errors when finalizing the aforementioned smart contracts). Also, because the markets created often touch on cryptocurrency trading, Automated Market Makers inherit their reliability. In other words, they will have problems when a new cryptocurrency also has functional issues.

Specialists also noted the relatively limited number of functionalities currently available on this type of platform, compared to more mature areas of the fintech industry, which are in the process of accelerated diversification.

Ultimately, the future of Automated Market Makers will be dictated by the general requirements of the fintech area. In my view, they are by no means limited to technology, but to the following things:

• Transparency/trend towards financial and technological education.

• Regulation and good practices.

• Shallow entry threshold: in the case of AMM, investors and Liquidity Providers can enter the market with minimal amounts. In the latter case, the necessary amount can start from $50k, which is low compared to the financial strength of traditional market makers.

• Usability/reliability/facilities from the user’s point of view.

Whatever the current shortcomings, I believe that Blockchain-based markets and tools will undoubtedly evolve in this direction, as is the case with the first such market, the cryptocurrencies market. The technology is far too valuable and versatile for such initiatives to stall, even if we might witness some bubbles and crashes. And that is precisely why I considered this introduction to be necessary.

You can follow me on Twitter and LinkedIn!