“The beginning is always today,” said Mary Shelley two centuries ago

She was quite optimistic, which comes as a surprise from a leading Romantic era exponent. Of course, she was talking about the excitement of an interesting adventure, a fresh day, a brand-new start.

In the trying times of Coronavirus, I keep my right to be realistic. There’s growing talk about the post-corona era, about how everything will come back to what it once was, how society will restart and pick-up from where it was left a few months ago, how economies will put all crisis behind and rise from the ashes. I’m confident that what we’re going through right now is just the beginning of a new epoch, the epoch in which nothing will be the same anymore.

The new normal

I’ve come to this conclusion by observing behaviors around me. From the muted cry of small entrepreneurs who try to find comfort in insufficient government stimulus programs to central banks that gave their all and then some, printing money out of nothing and throwing it in the face of the virus in the hope that this, the last weapon in their arsenal, will start making things right, economies rejoice, and people enthusiastically consume once again.

The underlining note in all of this is one thing: FEAR. Manifested in different forms and with various influences and vectors, but all in all, the same feeling: pure, unadulterated fear.

Business-wise, fear makes or breaks actions and thoughts, dismisses investment plans, smashes development budgets, fires employees, cuts innovation, research, development, affects investor sentiments, turns economic tigers into tame pussycats. Mind you; this is not a presumptuous forecast; this is the reality we’re living in now. This is the new world.

The Wuhan precedent

Let’s not kid ourselves; this is not an exercise of imagination; this is what some already tried. The best example is the lockdown relaxation and economic restart measures in what was, not long ago, the epicenter of this new world: Wuhan, China.

For them, after a 76-day total lockdown, with draconic measures taken to keep them inside at all times, the April 8 announcement of travel bans being lifted came as a literal breath of fresh air.

One month later, and shops are still closed, restaurants are turned into takeaway booths, businesses generate close to zero profits, production is still in shambles, bankruptcy is the new status quo. Already, the local economy contracted by at least 40% and prospects are grim.

Regardless of state-backed stimulus programs, zero-rent programs, employee cost covers, and many more, the economy does not seem to pick up.

The once-thriving 11 million people city is still in mental lockdown. Anxiety is the name of the new game.

Employees that had the luxury of being able to work from home don’t want to return to the office. People no longer frequent gyms, restaurants, cinemas, spas, salons, arcades, shopping malls, travel agencies, beauty parlors, neither the personal nor the professional life of most Wuhanese is now what it was a few months ago.

Authorities, even despotic, autocratic ones as the Chinese are, have no idea what’s going to happen, how to prepare for it, how to tackle it, and what to do if all else fails. It’s a trial and error process for Wuhan, for China, and pretty soon, for the rest of the world.

A mixed bag of information

So far, the pros and cons list contains most, if not all, measures and steps you hear about all day long, every time you turn on your TV or web browser:

Lockdown

- It surely works!

- It might not, it’s too soon to tell, look at the USA, see the protestors!

Ventilators

- Essential for life support during these trying times!

- Actually, studies are showing they don’t make much of a difference!

Remdesivir

- The magic drug that’s going to cure us all!

- Trial test after trial test showed that it has no positive effects and might, in some cases, even make matters worse!

Hydroxychloroquine

- Some guy says it cured him!

- Intensive medical studies find no relevant connection between it and Corona evolution!

Smokers are better protected

- Their lungs are more accustomed to harsh breathing conditions!

- How could that be, smoking kills, it says so on the pack!

Flattening the curve is the way to go

- Sounds smart and might work!

- There’s no proof yet this is the way to go for acquiring mass immunization!

For each contradictory affirmation, there are hundreds, if not thousands, of articles, pseudo-studies, reports, analysis… And with each of those, the general uncertainty about the future grows a little bit stronger.

For the average Joe and for Billion and Trillion-Dollar businesses:

- revenues and incomes plummet

- earnings are reaching new lows

- tens, if not hundreds of millions have already or are very close to losing their jobs

- productivity is sinking

- motivation becomes a scarce commodity

- people invent reasons for staying inside, in the comfort and safety of their homes

- entire market sectors close up

- the business world is transforming and all of us together with it

Until the Holy Grail, the vaccine, will be on the market, I see the anxiety described above as an ever-growing sentiment for all of us.

What does the future look like?

Covid-19 is here to stay, even the most optimistic medical scenarios don’t approximate a delivery data for the vaccine closer than 18 months.

Bracing for the second wave is easier said than done, because, in the end, in this new world, nobody knows what the future holds.

Caution is the word of the year, and it should be displayed both in a personal and a professional sense.

Not all people react the same way, and not everybody can work from home, cultures differ, lockdown measures affect each of us differently, central banks intervene in various ways in the markets, government policies that work in Wuhan might not be appropriate for Milan. We’re different, all of us, and now we find each other united by a common enemy and a common goal: survive, adapt, thrive.

Stay safe; stay healthy!

You can follow me on Twitter and LinkedIn

Understanding the advantages of AI is one thing; implementing it is another. Here are the steps to consider:

Understanding the advantages of AI is one thing; implementing it is another. Here are the steps to consider:

We focused on a two-pronged strategy over the last two years: adjustments to our corporate mission and changes for the benefit of users.

Talking about the way we organize:

• We began implementing the Agile method of working and wanted to make sure that all our procedures, processes, ways of working, executing, and so on were done digitally.

• This brought us the recognition of being named a Microsoft success story during the pandemic

• So, for a long time, we've been focusing on putting people, processes, connectivity, technology, time, and place together to determine the most appropriate and effective manner to complete a task or project

• For the clients, at a group level, due to market volatility and the enthusiasm associated with online trading, we started to build more products for them and better services. We took action towards lowering spread and fees which gave us an influx of new clients.

On top of it, we created our X-branded product line, which features QuantX, StoX, and ThematiX, and we are close to launching our investing service through DMA:

•

We focused on a two-pronged strategy over the last two years: adjustments to our corporate mission and changes for the benefit of users.

Talking about the way we organize:

• We began implementing the Agile method of working and wanted to make sure that all our procedures, processes, ways of working, executing, and so on were done digitally.

• This brought us the recognition of being named a Microsoft success story during the pandemic

• So, for a long time, we've been focusing on putting people, processes, connectivity, technology, time, and place together to determine the most appropriate and effective manner to complete a task or project

• For the clients, at a group level, due to market volatility and the enthusiasm associated with online trading, we started to build more products for them and better services. We took action towards lowering spread and fees which gave us an influx of new clients.

On top of it, we created our X-branded product line, which features QuantX, StoX, and ThematiX, and we are close to launching our investing service through DMA:

•  • The spirit of CAPEX.com is the spirit of the employees. We believe this because several of our departments in our company have a great number of young workers. The average employee age is around 27. 43 nationalities, countless cultures, an almost perfect balance between the number of ladies and gentlemen employed - we value and emphasize our team; this is why we always prefer to promote from within

• I believe it is because we began during the most difficult period in the markets, so we had to be forged by our environment and adapt to thrive. Today, online trading is entering a golden age, as many new types of users are joining the markets

• Because we can have a chance to prove that it doesn't matter that you start last, it's the classic "the tortoise and the hare" story - we are here for the long run; I see this business as a marathon, not a sprint. Others might have the advantage of time, but you can still become an influential company by hard work, thinking about the client, and the product

• The spirit of CAPEX.com is the spirit of the employees. We believe this because several of our departments in our company have a great number of young workers. The average employee age is around 27. 43 nationalities, countless cultures, an almost perfect balance between the number of ladies and gentlemen employed - we value and emphasize our team; this is why we always prefer to promote from within

• I believe it is because we began during the most difficult period in the markets, so we had to be forged by our environment and adapt to thrive. Today, online trading is entering a golden age, as many new types of users are joining the markets

• Because we can have a chance to prove that it doesn't matter that you start last, it's the classic "the tortoise and the hare" story - we are here for the long run; I see this business as a marathon, not a sprint. Others might have the advantage of time, but you can still become an influential company by hard work, thinking about the client, and the product

I suppose it's all about democratization these days. This is the term that comes to mind. Democratization benefits not only clients/users of financial instruments or banking but also smaller businesses, which can now accomplish more with fewer resources. This is possible because of the future represented by low-code or no-code, which is predicted to expand at a 44.4% annual pace by the end of 2022, API connections, and other factors.

Today, you can connect the dots to create exceptional products in much less time than a few years ago and still maintain a competitive advantage. Fintechs are becoming more and more popular year after year, and brokerages have begun to shift their focus from traditional brokerage/investment firms to product or marketing firms while maintaining a compliance focus.

I suppose it's all about democratization these days. This is the term that comes to mind. Democratization benefits not only clients/users of financial instruments or banking but also smaller businesses, which can now accomplish more with fewer resources. This is possible because of the future represented by low-code or no-code, which is predicted to expand at a 44.4% annual pace by the end of 2022, API connections, and other factors.

Today, you can connect the dots to create exceptional products in much less time than a few years ago and still maintain a competitive advantage. Fintechs are becoming more and more popular year after year, and brokerages have begun to shift their focus from traditional brokerage/investment firms to product or marketing firms while maintaining a compliance focus.

I won't go into great depth now because I know part of CAPEX.com's success is due to a better mindset that says: be humble, modest, and friendly, disclose less and deliver more.

I'll just mention a few tracking points:

• We launched new products last year; we are focusing on the same vision this year. Launch products that users can use and benefit from

• Reach exciting markets

• Have more licenses so we can give better services

• Implement new verticals for our one-stop-shop mindset

I won't go into great depth now because I know part of CAPEX.com's success is due to a better mindset that says: be humble, modest, and friendly, disclose less and deliver more.

I'll just mention a few tracking points:

• We launched new products last year; we are focusing on the same vision this year. Launch products that users can use and benefit from

• Reach exciting markets

• Have more licenses so we can give better services

• Implement new verticals for our one-stop-shop mindset

Romanian online businesses continue to flourish even after the relaxation of restrictions

According to data supplied by MerchantPro, between June and August 2020, there were 52% more transactions placed compared to the same period of 2019. For the record, MerchantPro accounts for orders placed on over 1.500 online shops in Romania.

This comes as a surprise to me since the Romanian government relaxed restrictions several months ago. Yet, online shopping performance wasn't affected at all. On the contrary, its growing trend never halted.

We have a fact: the new e-commerce dynamics from the start of the pandemic show growth in six months, similar to three years in a familiar context. And with no end in sight for the COVID-19 pandemic, this trend might as well carry on.

Before getting into studies, examples, and analysis, let's talk about what makes the e-commerce sector, such as an enticing business to invest in.

Romanian online businesses continue to flourish even after the relaxation of restrictions

According to data supplied by MerchantPro, between June and August 2020, there were 52% more transactions placed compared to the same period of 2019. For the record, MerchantPro accounts for orders placed on over 1.500 online shops in Romania.

This comes as a surprise to me since the Romanian government relaxed restrictions several months ago. Yet, online shopping performance wasn't affected at all. On the contrary, its growing trend never halted.

We have a fact: the new e-commerce dynamics from the start of the pandemic show growth in six months, similar to three years in a familiar context. And with no end in sight for the COVID-19 pandemic, this trend might as well carry on.

Before getting into studies, examples, and analysis, let's talk about what makes the e-commerce sector, such as an enticing business to invest in.

ADVANTAGES OF STARTING AN E-COMMERCE BRAND

ADVANTAGES OF STARTING AN E-COMMERCE BRAND

According to ecommercedb.com, eMag ranked first in the e-commerce sector last year, with a revenue of $682 million. dedeman.ro came in second place, scoring $80 million revenue, $3 million more than pcgarage.ro, the no.3 online shop in my beloved country.

No surprise so far. But I need to mention one incredibly exciting fact you ought to know: these three online shops account for half of the revenue generated from e-commerce businesses in Romania, or so ecommercedb.com states.

Side note: the website I cited as source bases its rankings on every store that generates Romania's revenue. These stores can either have a national focus and only sell in their primary country or operate globally. For this evaluation, it took into consideration only the revenue created in Romania.

What the past, the present, and the future tell us about e-commerce in Romania

Why should you invest in Romanian e-commerce? What's so appealing about this industry apart from the obvious things? I have not answered these questions yet, but the time has come to address them.

Revenue is expected to soar approx. 40% year-over-year, user numbers to increase by 11%

During my research into the Romanian e-commerce market, I stumbled upon some exciting data regarding this industry.

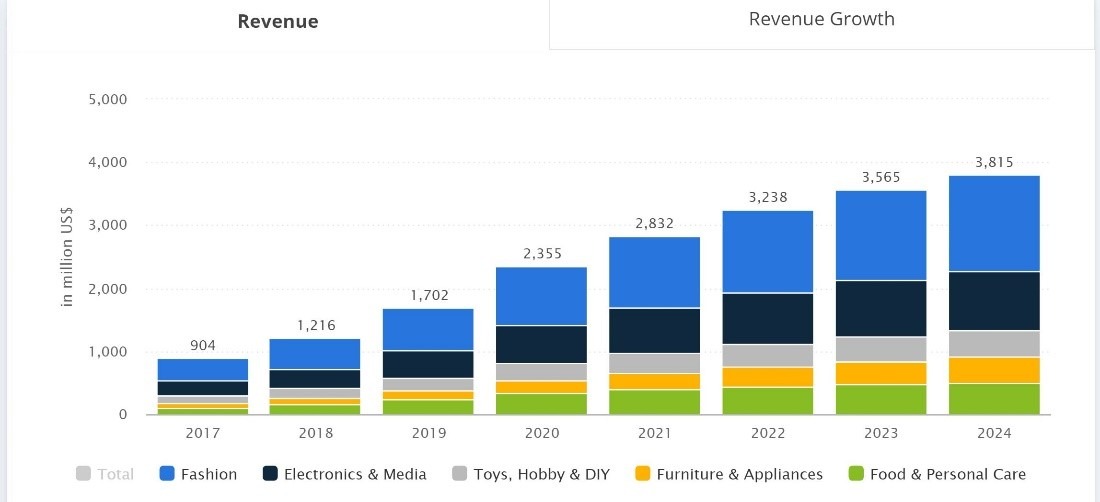

For instance, online shops could hit $2,35 billion in 2020 – a whopping 38.4% jump from $1,702 billion in 2019. Moreover, the e-commerce market could turn into a $3,815 billion industry by 2024, double the amount expected for 2020.

The market's largest segment is Fashion, with a projected market volume of $943 million in 2020. Electronics & media, toys, hobby and DIY, Furniture & Appliances, and Food & Personal Care account for the other major industries.

According to ecommercedb.com, eMag ranked first in the e-commerce sector last year, with a revenue of $682 million. dedeman.ro came in second place, scoring $80 million revenue, $3 million more than pcgarage.ro, the no.3 online shop in my beloved country.

No surprise so far. But I need to mention one incredibly exciting fact you ought to know: these three online shops account for half of the revenue generated from e-commerce businesses in Romania, or so ecommercedb.com states.

Side note: the website I cited as source bases its rankings on every store that generates Romania's revenue. These stores can either have a national focus and only sell in their primary country or operate globally. For this evaluation, it took into consideration only the revenue created in Romania.

What the past, the present, and the future tell us about e-commerce in Romania

Why should you invest in Romanian e-commerce? What's so appealing about this industry apart from the obvious things? I have not answered these questions yet, but the time has come to address them.

Revenue is expected to soar approx. 40% year-over-year, user numbers to increase by 11%

During my research into the Romanian e-commerce market, I stumbled upon some exciting data regarding this industry.

For instance, online shops could hit $2,35 billion in 2020 – a whopping 38.4% jump from $1,702 billion in 2019. Moreover, the e-commerce market could turn into a $3,815 billion industry by 2024, double the amount expected for 2020.

The market's largest segment is Fashion, with a projected market volume of $943 million in 2020. Electronics & media, toys, hobby and DIY, Furniture & Appliances, and Food & Personal Care account for the other major industries.

Graph showing Romania's e-commerce revenue from 2017 to 2024 (achieved and forecasted), and the most relevant industries contributing to it - statista.com

Buyers gather in increasingly larger numbers, women lead

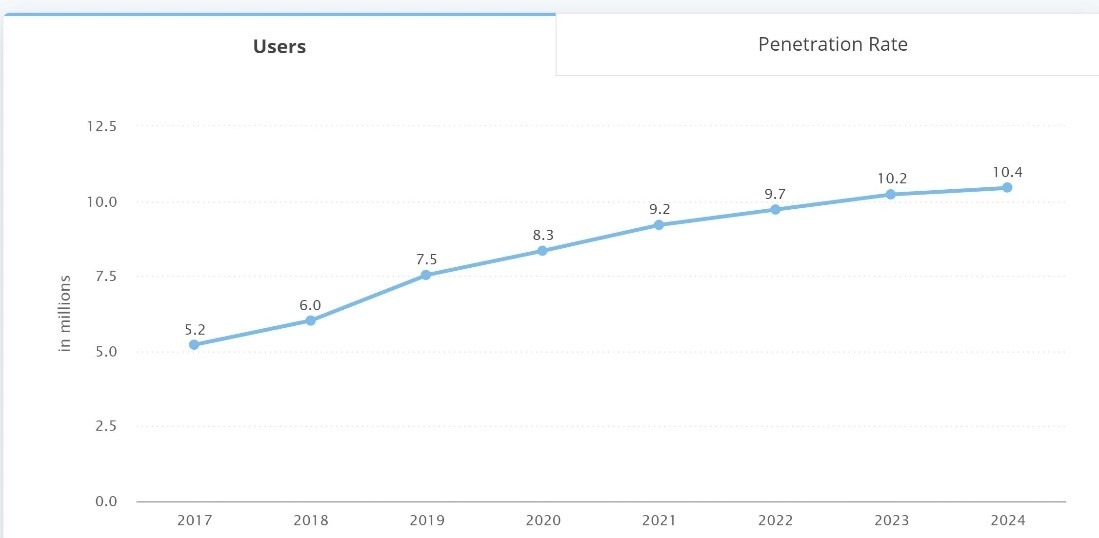

Another growth factor for the e-commerce market in Romania is the number of users, which is expected to amount to 10.4 million by 2024. Compared to 2019, 2020 could witness a 10,7% increase in users shopping online.

Graph showing Romania's e-commerce revenue from 2017 to 2024 (achieved and forecasted), and the most relevant industries contributing to it - statista.com

Buyers gather in increasingly larger numbers, women lead

Another growth factor for the e-commerce market in Romania is the number of users, which is expected to amount to 10.4 million by 2024. Compared to 2019, 2020 could witness a 10,7% increase in users shopping online.

Graph showing Romania's e-commerce users growth from 2017 to 2024 – statista.com

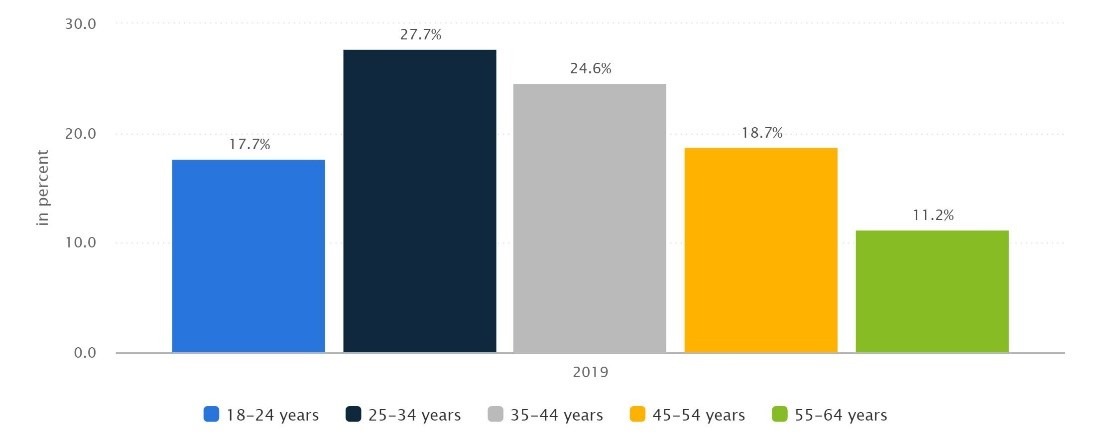

In 2019, 27.7% of e-commerce users fell into the 25-34 age category, which accounted for most online visits. Customers aged 35-44 followed, with 24.6%. Most people who buy online are women (51.4%).

Graph showing Romania's e-commerce users growth from 2017 to 2024 – statista.com

In 2019, 27.7% of e-commerce users fell into the 25-34 age category, which accounted for most online visits. Customers aged 35-44 followed, with 24.6%. Most people who buy online are women (51.4%).

Graph: statista.com

Romania compared to the rest of the world.

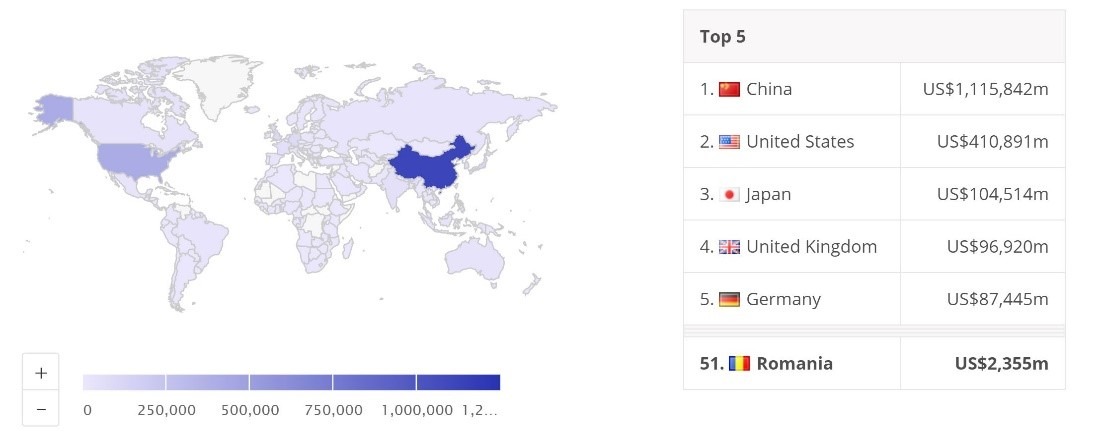

With a projected market volume of $1,115 trillion in 2020, analysts expect China to generate the most revenue from e-commerce. The United States, Japan, U.K, and Germany could follow suit. Romania sits comfortably on the 51st place.

Graph: statista.com

Romania compared to the rest of the world.

With a projected market volume of $1,115 trillion in 2020, analysts expect China to generate the most revenue from e-commerce. The United States, Japan, U.K, and Germany could follow suit. Romania sits comfortably on the 51st place.

Graph: statista.com

All things point towards investing in the e-commerce market, yet...

...Eurostat points out that 23% of the Romanian population shopped online in 2019, which places us on the second to last place in the EU, only ahead of our Bulgarian neighbors. This fact might show that Romanian e-commerce has a lot of space to grow OR that we still have a long way to go to join the big names, depending on how you see things.

As for myself, I like to focus on the positives, so I'll leave you with a good stat: Romanians spent around 12 million euros/day on online shopping daily last year, compared to 9.86 million euros/day, the average of 2018. And where's potential for such growth, there's also a potential for extraordinary opportunities.

You can follow me on

Graph: statista.com

All things point towards investing in the e-commerce market, yet...

...Eurostat points out that 23% of the Romanian population shopped online in 2019, which places us on the second to last place in the EU, only ahead of our Bulgarian neighbors. This fact might show that Romanian e-commerce has a lot of space to grow OR that we still have a long way to go to join the big names, depending on how you see things.

As for myself, I like to focus on the positives, so I'll leave you with a good stat: Romanians spent around 12 million euros/day on online shopping daily last year, compared to 9.86 million euros/day, the average of 2018. And where's potential for such growth, there's also a potential for extraordinary opportunities.

You can follow me on