This is the third post in the Building a Brokerage House series. The first article sketched the business’s general layout, helping you define your services, product package, and target audience, while the second article put the intricate regulation side in perspective.

I’m about to go deeper into the subject and reveal the next moves you need to make to see your business take off and adjust your strategies as you go along.

Every broker-dealer is different, but calibrating technology to your business model follows the same pattern, so I’ll share a breakdown of costs, skills, technology & payment providers, connection to exchanges, and everything else I find useful for you to know.

Internal vs. Outsourced Development

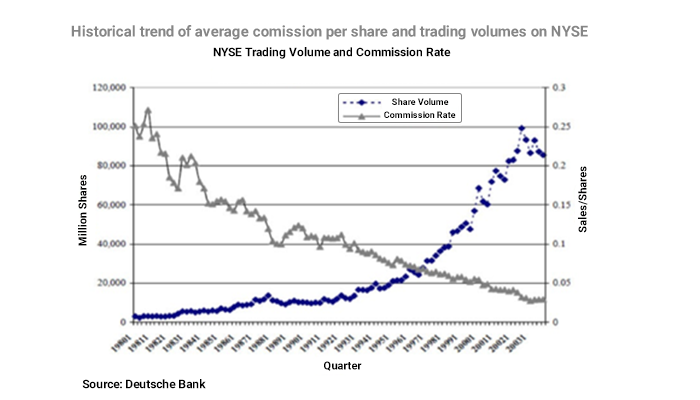

Between 2000-2005 trading was the prerogative of informed and institutional investors. However, with the growing internet and smartphone spike, technology has rewired the trading infrastructure, allowing retail clients to access the markets and use derivative instruments, increasing trading volumes and liquidity.

Because everyone is now focusing on technology, your startup needs to constantly advance the backend & frontend and automate most of the processes, but first, you’ll have to choose between:

1. Internal Development

2. Outsourced Development

3. A mix between Internal and Outsourced

Internal Development

Most of us dream of becoming the architects of our vision, but it’s paramount to understand that doing everything in-house may involve not only huge costs but teams of highly-skilled professionals. You may spend hundreds, if not millions of euros a year and gain an advantage of nanoseconds over your competitors.

Pros:

- You build everything from scratch and get total freedom over design, features, integration, and functionalities.

- You adjust along the way and save time by not waiting for outsourced developers to start working on your requests.

- You manage your own teams, which gives you a free hand in picking them out and leading them towards your goals.

Cons:

- The overall costs are massive and could cripple your business from the start.

- It’s not cheap to have Dev-Ops Engineers, considering they rank in the top five of all tech salaries, commanding an average pay of €106,000.

- It’s unrealistic to claim that the entire technology ecosystem can be developed internally, so you’ll have to reach deep into your pocket and pay for extra services and integrations as well.

Outsourced Development

This approach may be sensible for a brokerage house just starting out. Paying for already-developed services, such as a Whitelabel, with rule-based automation can spare you the nuisance of doing everything yourself. You’ll be able to focus on improving the customer experience, create partnerships to sustain your cash flow needs, and strategize for better and faster ROIs.

Pros:

- The start-off is cheaper, ranging from €250,000 to €500,000, and it gives you extra space to funnel your funds into other areas of your business.

- You get a determined product package accompanied by a support network.

- Apart from the platform and features, they provide API for all your other integration processes.

Cons:

- Most of the 3rd party services you pay for are pre-built with little room for development or customization.

- You still have to make a lot of additional integrations and pay tens of thousands per month for hosting, technical support, maintenance & change requests, feed, liquidity, and Back Office.

- Depending on the business plan you acquire and the technology provider’s availability and priorities, all your development tickets will take time.

- You just rent the technology, you don’t own it, which means that every additional request will pile up as an extra cost for you.

A mix between Internal and Outsourced

In my experience, paying for a Whitelabel and adding internal developments might be what you’re looking for at this point.

You can buy the platform & features, brand them, negotiate as much as you can for extended permissions to customize, then proceed with the CRM, payments, and liquidity processors integrations yourself. Basically, you need a predefined structure that you can fashion to your necessities.

Essential Integrations to Get the Ball Rolling

You now have a functional platform with various features. But there’s no business without clients, and you’re not going to have them unless you start receiving online payments.

Choose the Best Payment Provider for Your Business

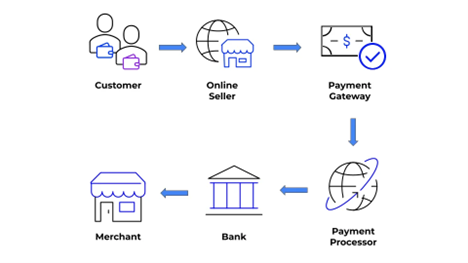

If you want to smoothly run your customer payment process and set up your cash flow, online payments via payment gateways are the best way to go. You need a well-built system to handle sensitive information when charging clients’ debit/credit cards.

The gateway transfers the transaction data and approves or declines the payment. This is when the payment processor comes in and acts as a mediator between the cardholder, merchant, acquiring bank, gateway, and issuing bank. It groups and manages all clients in one big merchant account, with almost the same rate and fee for all clients.

Choose your PSP based on:

1. Overall reputation: focus on longevity, quality, and level of support.

2. Service package: international coverage and multiple payment methods (debit cards, e-wallets, prepaid cards, mobile payments).

3. Technical requirements: API & iFrame connections.

4. Security protocols: the PSP must adhere to worldwide security standards, such as Payment Card Industry Data Security Standard (PCI DSS).

5. Account opening process: find out if it’s lengthy, time-consuming, or straightforward and less complicated.

6. Support services: a large number of payment rejection rates can lead to reduced profits. You’ll have to pay additional costs by 3–4.5% of direct debit payments for collections and warnings. Most PSPs can provide risk protection services to eliminate these additional charges.

7. Costs: PSPs usually have a one-time setup fee and a fixed monthly cost that could start as low as €475.

As a brokerage firm, you’ll also need to store customers’ funds in separate bank accounts, to ensure that they will never be misappropriated.

Segregated accounts mean that the company cannot use the funds to conduct business operations. The money is secure in case the company goes bankrupt. Traders are more likely to trust brokers that offer segregated bank accounts, so it’s a win-win situation.

Liquidity Providers & Connection to Exchanges

A liquid market translates into smoother transaction flows and competitive pricing, so liquidity provision is essential for effective trading. The main purpose of a liquidity provider is to ensure an uninterrupted flow between demand and supply and provide the best buy and sell prices.

If you choose an Electronic Communications Network/Straight Through Processing (ECN/STP) network to execute your clients’ trades, make sure to connect to multiple Tier 1 liquidity providers to secure the best spreads and dealing rates.

When brokers connect to the exchanges, they typically use the FIX Protocol (Financial Information eXchange.) Most trading systems have FIX API connections available.

To find the best liquidity provider, you’ll have to analyze several factors:

1. Overall package: should provide multi-asset liquidity, nominated account in different currencies, and access to the FIX protocol and historical data.

2. Market depth: a high number of buy and sell at each price suggests a higher market depth, indicating market liquidity.

3. Fast execution: with re-quotes or slippage.

4. Pricing: competitive spreads and low commissions.

5. Data feeds: stable & reliable with feeds reflecting real-time prices from various exchanges.

6. Regulation: for best practices, the liquidity provider should adhere to strict rules and comply with regulations the same way a broker does.

7. Reporting: automated and compliant reporting system: trades, FIX bridge, swaps & rollovers, order book access.

8. Software: FIX protocol and other APIs, MT5 bridge connections, FIX bridges.

Cost Estimates and How Brokers Make Money

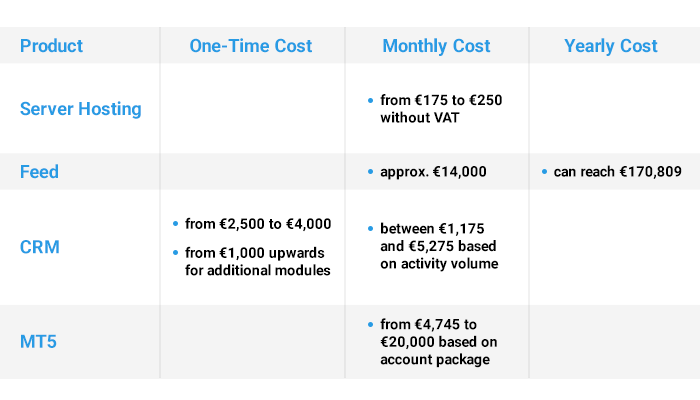

Apart from the core technology, there are additional costs for all integrations you need. You want extra features – you need to pay. You want constant developments – it adds up to your monthly bill. All service providers have various business plans you can choose from, and most of them leave room for negotiation, so write down your necessities and start searching for the ideal setup.

I’ve rounded up some of the most important integrations you’ll have to make and the average costs of covering them.

As for profits, you need to understand that commissions on trades are now a relic of the past since Robinhood disruptively eliminated them. You can still apply deposits/ withdrawals, inactivity, and overnight fees. Like most players in the industry, you can choose the bid-ask spread as a key source of revenue.

Conclusion

Nothing is as easy as it seems, especially when you want to go the entrepreneurial way. Building a Brokerage House takes more than just basic knowledge about the financial markets. It requires a large capital and in-depth research, high technology with key people, a great deal of willpower on your part, negotiation skills, and a trained eye for innovation opportunities. Expect the worst, but aim for the best and be prepared for a lengthy process. Even so, the rewards will definitely outmatch the obstacles and difficulties along the way. There are still some important sides of the business you need to be aware of, but I’ll leave it for the following articles in the series.

You can follow me on Twitter and LinkedIn!